Which of the Following Is a Result of Adverse Selection

C firms need to rely more on accumulated profits. Adverse selection occurs when there is a difference in information between the buyer and seller.

A The lender has a problem of distinguishing good risk from bad risk borrowers.

. A The insurers financial results will be substantially improved. Studying principal-agent models with adverse selection is usual in economic contract theory. Those who want to buy insurance are those most likely to make a claim.

Which of the following is a result of adverse selection. This can increase costs lower consumption exclude customers and potential increase the health risk. Have less incentive to maintain the value of their cars than new car.

A situation where there is a tendency to take undue risks because the costs are not borne by the party taking the risk. Adverse selection occurs when there is asymmetric unequal information between buyers and sellers. D Insurance can be written only by the federal government.

The lender has a problem of distinguishing good risk from bad risk borrowers. Adverse selection occurs in the market for used cars because used car buyers. Results in fewer market transactions.

C It is unnecessary for the insurance company to use underwriting. When catastrophic losses occur as a result of a natural disaster d. B banks have an information-cost advantage in reducing adverse selection problems.

It occurs in the used-car market but not in the market for insurance. B Persons most likely to have losses are also most likely to seek insurance at standard rates. All of the following are consequences of adverse selection on good firms EXCEPT A the cost of external financing increases.

Which of the following is a problem of adverse selection a. Higher Prices for Customers. C interest paid on bank loans is deductible against the corporate income tax whereas interest paid on corporate bonds is not.

Which of the following is not true of adverse selection. A lack of equal information causes economic imbalances that result in adverse selection and moral hazards. It can result when one of the parties in a transaction has little information about the quality of the goods involved.

D government regulators encourage small businesses to obtain. Individuals use more medical services as a result of their purchase of a health insurance plan. For example buyers of insurance may have better information than sellers.

A no underwriting is necessary b the applicants for insurance have a higher probability of loss than the average group of insureds c the federal government must write the insurance d better insureds are attracted to the group e large insurers are able to charge lower premiums. Adverse selection is a common scenario in the insurance sector Commercial Insurance Broker A commercial insurance broker is an individual tasked with acting as an intermediary between insurance providers and customers where people in high-risk lifestyles or those engaged in dangerous jobs sign up for life insurance coverage as a way of. A person takes up the hobby of bungee jumping after purchasing health insurance.

Insurance can be written only by the federal government. D firms will only be able to attain financing from the government. 15 Which of the following is a result of adverse selection.

It is unnecessary for the insurance company to use underwriting. Have more information than used car sellers. A the interest rates on bank loans are usually lower than interest rates on corporate bonds.

It drives out the high-quality products and only the low-quality products are left in a market. D None of the above. Makes it easier for all customers to find what they want.

B The lender has a problem determining that the proceeds from a loan are being used as the borrower stated. Which of the following four options is a possible result of adverse selection. Which of the following is a problem of adverse selection.

All of these economic weaknesses have the potential to lead to market failure. When individuals intentionally bring about a loss in order to collect from an insurer c. Increases the efficiency of most markets.

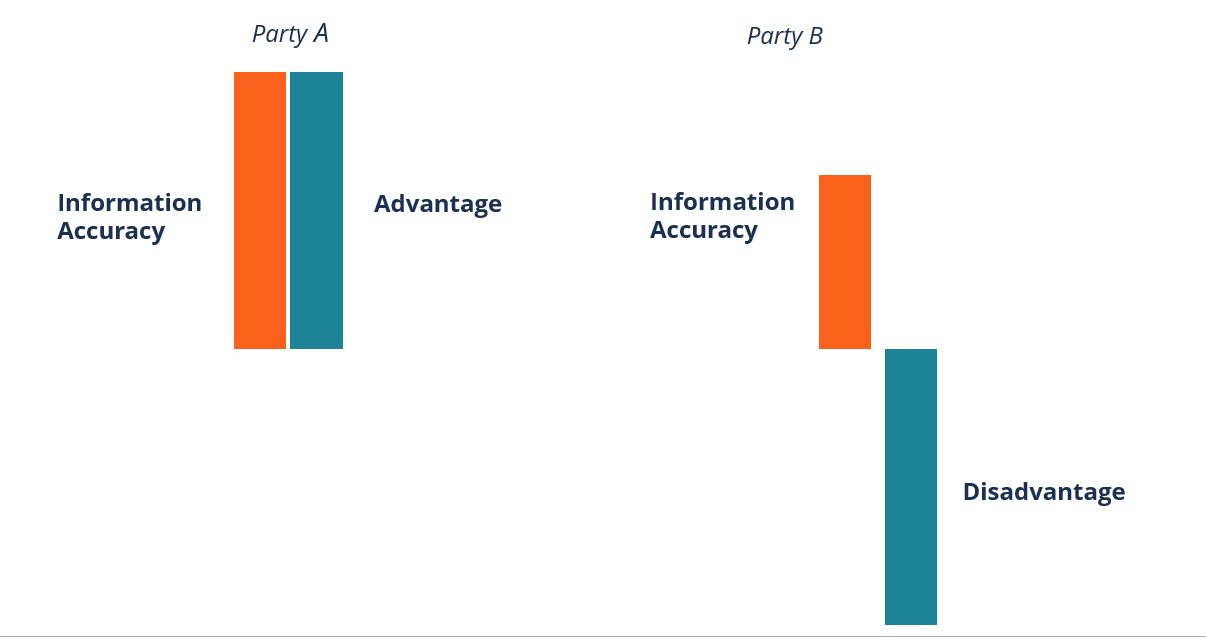

Adverse selection refers generally to a situation in which sellers have information that buyers do not have or vice versa about some aspect of product quality. Usually causes prices to adjust faster than they otherwise would. When applicants with a higher-than-average chance of loss seek insurance at standard rates.

C A person takes up the hobby of bungee jumping after they purchase health insurance. This unequal information distorts the market and leads to market failure. A store manager shirks.

Only lemons remain in the market for used cars. B firms need to rely more on internal funds. Which of the following is a result of adverse selection.

Adverse selection occurs a. Tend to have more accidents than new car buyers. Both moral hazard and adverse selection are used in economics risk management and insurance to describe situations where one party is at a disadvantage as a result of another partys behavior.

Examples of the effects of adverse selection include. In such models agents preferences are given by a parametrized utility function where θ the parameter is an individual unobservable characteristic of the agent belonging to Ω the set of types x A in all the following is the agents. Those persons who are most likely to have losses are also themost likely to seek insurance at standard rates.

When adverse selection is allowed to continue unchecked it results in a death spiral that causes insurance companies to lose money on certain plans and consequently no. When an insurance company loses money on its investments b.

Idk It Fits In Starkid Too Harry Potter Girl Harry Potter Actors Harry Potter Series

Comments

Post a Comment